A dive into Seso's business model

I have been training my taste for spotting companies with good business models, so I can craft a good model for my company.

Seso is one of the good cases; it is a boring business that most people would overlook, but a great case study to dive in.

Seso is a workforce software / HR tech startup that raised a total of ~$50M to solve labor management and compliance problems in agriculture. It provides a platform for H-2A visa processing, worker recruitment, compliance tracking and operation management, digitalizing a paper-intensive & consultant-dependent process.

While streamlining the H-2A visa application workflow, Seso also created a 2-sided marketplace for qualified agricultural labors.

To me, Seso is very unsexy (it probably is to lots of people) and I thought it was solving a very niche problem. However I was definitely overlooking the value it created, until I knew that NFX invested in them and until I worked through the math with GPT.

This process taught me to appreciate a good business model and look at every company from a different angle (business angle versus tech / product angle)

So let’s look at the market.

H-2A isn’t a niche anymore, in 2024 there are ~400k H-2A visas issued (up 7x since 2005), apparently this accounts for 17-20% of the U.S. hired ag workforce… so it’s not a small market for sure. Plus the industry tailwind (U.S. facing severe labor shortages, I believe the number will keep going up).

Also, an important note is that H-2A is recurring; ag companies have to refile every year when they need workers. The filling process is also pretty complex so that growers almost always need to hire agent / consultant / law firm to fulfill that job.

Even though farms might only hire 1-2 batches of workers a year, once the workers are stationed you now have to deal with all the ops and admin work, which Seso comes in to help manage.

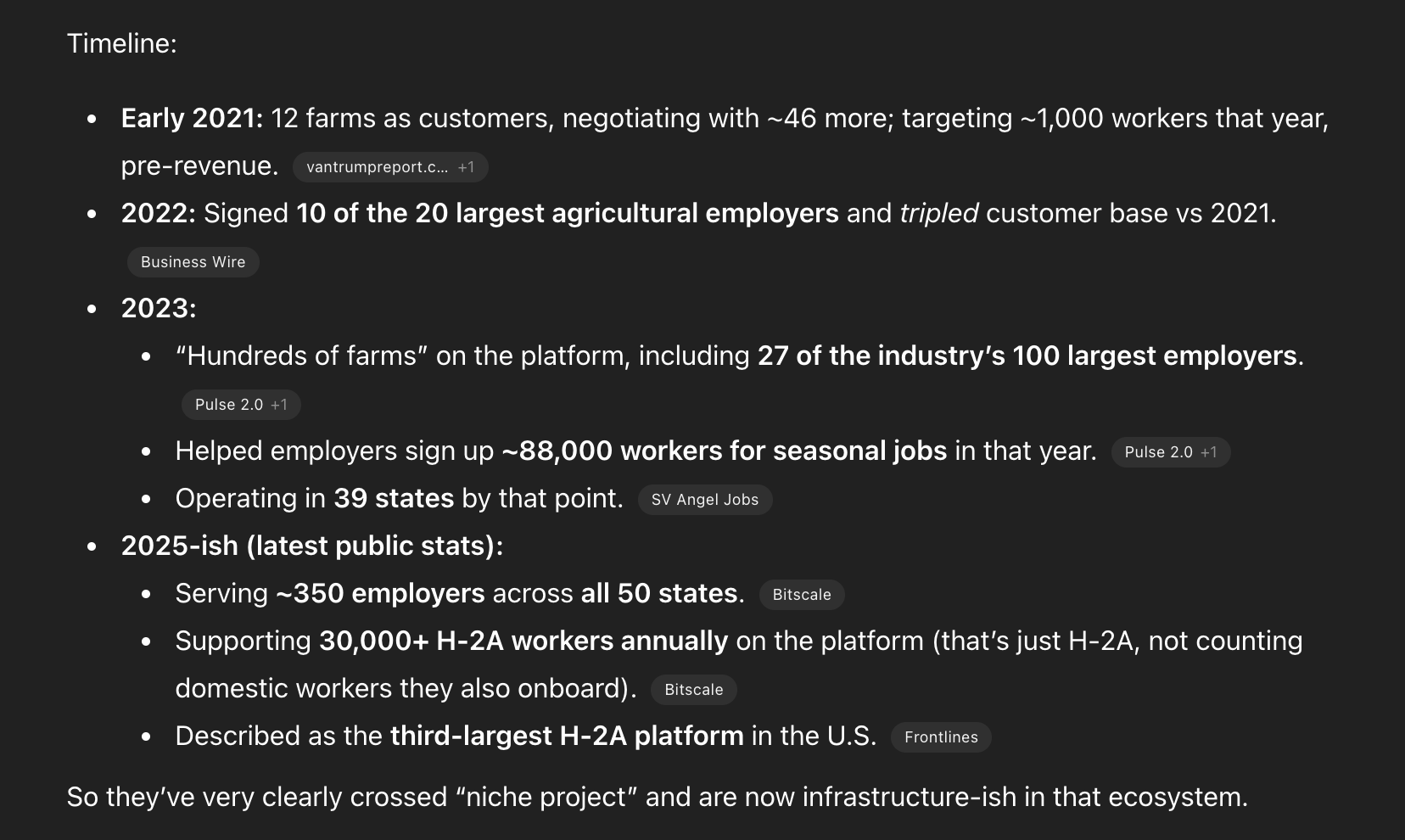

Let’s look at tractions, I did some research with GPT and Seso’s growth is quite impressive: 4 years after launch, they were already serving 350 customers and supporting 30k+ H-2A workers annually.

Let’s look at the business model - I thought its as originally a monthly SaaS pricing, turns out it’s a lot more stackable and dynamic.

There are three revenue streams:

1/ H2A agent + paperwork automation Early on they were charging $1k per worker which is 20% cheaper than existing alternative (finding an attorney), but now they expanded the service to be more modular:

- $2,000 implementation (one-time, first-time filer)

- $5,500 for labor certification,

- $1,500 for I-129 filing,

- $500–1,850 for advertising,

- plus per-worker consulate fees, etc

I believe this is the bread and butter - high ticket sizing.

2/ vertical HR / workforce management SaaS - Think about all the payroll, onboarding, attendance & time modules, this is the classic vertical SaaS model, pricing is unknown though.

3/ Managed services - logistics, support, embedded finance, etc

Using numbers from the market analysis section, we can compute their growth potential

In 2024 alone there are ~400k H-2A workers, so the H-2A agent service TAM is 400k * 400 - 800M.

Then the second layer is the vertical HR SaaS - if it’s 36M a year. If eventually it expands to all ag workers (there’s 1.5M last year) then that is $120M / year TAM for ag HR SaaS.

Lastly the embedded finance part - there’s 250 - 500M TAM.

Total combined TAM is in the range of 1.2B…

So it’s a pretty good business model, because it’s multi-layered and stackable, 3 different revenue streams. Moat is strong - deep in the weeds of immigrant agriculture labor, potential for becoming the system of context for ag labor, data nfx coming from all the paperwork and visa applications filing, as well as the qualified labor marketplace.